According to the most recent studies, 53.8% of transactions in the country are currently made in the US currency.

Does the phenomenon of dollarization is here to stay in Venezuela?

By Actualidad.RT / Jessica Dos Santos

Wednesday, 12/11/2019 09:57 PM

December 11, 2019.-

According to some economic experts, of the most varied political ideologies, Venezuela would have experienced, in recent weeks, a certain revival of the economy, a statement that is based on the rebound in economic transactions.

"What we are living is a small economic recovery after all that monstrous fall we have had and, depending on what happens in the interim of the first quarters of the year, that recovery can be pronounced a little, I am not talking about something definitive or that the crisis is over, but I think next year will be a little better, " said economist Daniel Lahoud.

Similarly, the economic analyst Tomás Socías López considers that in the last days there have been "some beginnings of movements and activation of the economy".

"It is estimated that sales have increased close to 20 % . There is a greater influx to establishments and an increase in sales, especially of household appliances, which has had more growth in recent days," said Socias López.

In fact, the merchants of the country decided, for the first time in the history of the nation, to replicate the American experience called 'Black Friday' in order to increase sales. But not all economists consider that a symptom of recovery.

Venezuelans look at products while shopping during Black Friday - Mario Caicedo / Reuters

"For me, this refers to the seasonal phenomenon of Christmas shopping, which always marks a contrast with the rest of the year. Last year there was also a live-up experience, although on a smaller scale, encouraged by remittances sent just for that purpose. Christmas, but this year, in addition to remittances, we have bonus payments and some in dollars, to which we must add the fact that in the economy the dollars are circulating more , they are no longer used only for hoarding or special payments, but they have more and more acceptance, "explains sociologist and political economist Luis Salas to RT, who believes that" the test to talk about a recovery is not December but the first quarter of the year 2020. "

Meanwhile, economist Luis Enrique Gavazut adds another edge. "That there is a slight increase in sales does not reflect an economic recovery. The de facto dollarization process has led to a greater presence and use of foreign exchange, which has slightly increased imports of final consumer products and the acquisition of But it is not an increase in the supply for investment and national production , which is what is really needed, "he explains in dialogue with this medium.

Luis Enrique Gavazut, economist

"There is severe restriction of monetary liquidity in bolivars. By not having how to change currencies to bolivars, they use them directly, and this has increased the circulation of the dollar freely."

From the hand of the dollar

The truth is that a significant percentage of these transactions are made in dollars, despite the fact that in Venezuela the only legal tender is the Bolívar.

According to the private firm Ecoanalítica, currently 53.8% of transactions in Venezuela are made in dollars: almost all appliances are bought in that currency, as well as more than half of the clothes, spare parts for cars and food, among other items. This data is based on the study of 12,600 registered operations, between October 10 and 15, in 136 stores in Venezuela.

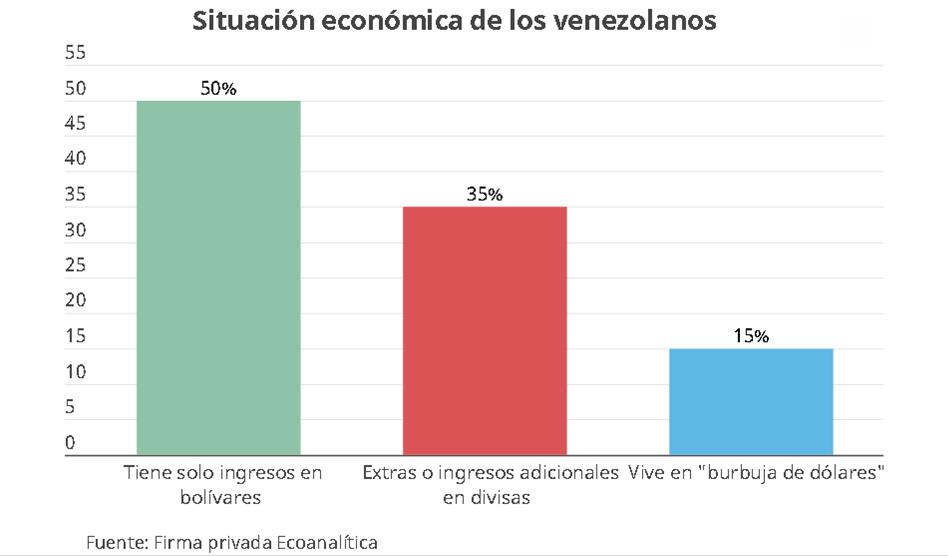

According to that report, 50% of the Venezuelan population is caught in hyperinflation, especially pensioners and public employees; 35% of the inhabitants are maintained with some foreign exchange income; and another 15% live from the so-called 'dollar bubble', which allows them to maintain high levels of consumption.

From the official sector there are no figures in this regard. However, on November 17, President Nicolás Maduro, showed for the first time that the government is aware of the situation.

"I, perhaps what I will say will be a sin for the owners of dogmas, I do not see it badly. I declare myself a sinner: I do not see it badly. Evaluate how this process, which they call dollarization, can be used for the recovery and deployment of productive forces and the functioning of the economy. It is an escape valve, thank God it exists, "Maduro said, in statements he would repeat last Tuesday.

The Venezuelan president argues that dollarization arose from the "necessary self-regulation" of the Venezuelan economy to ensure the " slowdown in induced criminal inflation ."

#EnVideo| Presidente @NicolasMaduro, en entrevista con José Vicente Rangel: Ese proceso que llaman dolarización puede servir para la recuperación de las fuerzas productivas, pero #Venezuela siempre tendrá su moneda: el bolívar, y vamos a recuperarlo#VictoriaPerfectaDePaz

539 people are talking about this

"That process they call dollarization"

However, is Venezuela really in a process of dollarization? Analysts such as the opposition Luis Vicente León, economist and president of Datanlisis, say that there is no such process in the country, in a "formal, comprehensive, rational and efficient way".

"What there is is a de facto and disorderly massification of the use of currencies to respond to the loss of value of the bolivar," he says .

The local currency of Venezuela is the bolivar, but the state allows operations in dollars. Even at street stalls selling hot dogs, famous in the South American country, sellers use the US currency.

"There is severe restriction of monetary liquidity in bolivars. So, people who own foreign exchange, either because they have accumulated them for years, receive them for remittances or have any commercial operation of goods or services, having no way to change them to bolivars, they use them directly, and this has increased the circulation of the dollar freely, "explains Gavazut.

But despite this situation and that the dollar is already the reference unit for calculating prices, labor contracts and bank accounts remain in bolivars, two key points that do not allow us to talk about a systematic dollarization. But, in addition, can Venezuela really move towards a formal dollarization amid the strong unilateral sanctions of the US government?

A street vendor counts dollar bills on a street in Caracas

Federico Parra / AFP

Dollarization with sanctions?

"There is a growth in dollar transactions, which does not necessarily imply that there are many more dollars than before. There is more, yes, but what has grown the most is their liquidity or circulation, because they are not only used as a reserve of value or accounting unit, but as a payment currency for daily operations. That is, they pass more from hand to hand and produce the illusion that “everyone has dollars.” But, that this becomes a dollarization? remains to be seen, "adds Salas.

For this expert, more than a "dollarization", today Venezuela is experiencing a "de-privatization", " a disorderly flight from the bolivar to any other means of payment."

Salas explains that the 'flight' is majority towards the dollars "but also, for example, gold in Guyana or the Colombian peso on the western border. And, in the case of the government, towards the Petro cryptocurrency, and many individuals , in cities like Caracas, towards crypto in general. "

Salas warns that this process can lead to three aspects: a multi-monetary regime, such as that of Zimbabwe, where up to nine different currencies plus crypto came to circulate; one 'bimonetario', as in Cuba; or, indeed, to a formal dollarization type Ecuador. But, in order for the latter to occur, the Constitution must be amended and all the appropriate adaptation made.

Luis Salas, sociologist and expert in economics

"For a dollarization, in our case, an additional one would be necessary: the lifting of the sanctions, since the restrictions imposed by the US make it impossible for the correspondent work of the banks and even with the Federal Reserve."

As paradoxical as it sounds, it seems that the main operational obstacle to a dollarization in Venezuela is the sanctions of the US government against the beaten economy of the South American country.

Jessica Dos Santos

Note read about 976 times.

The most read News

Las Noticias más recientes

No comments:

Post a Comment